Last week has been called by many scary names all referring to crash szenarios. The EuroStoxx 50 has gone down to 2,960 points just to go up again to 3,280 points on Friday closing. The Volatility went up to over 30 points, too.

In fact, for my options strategy the week has been worse then ever. All in all I have lost roughly 50 % of my money in just this week. Honestly, that is not acceptable at all and a real catastrophe.

Looking back on my

Performance Report in week 34 I have to say, that I fulfilled the plan and opened the straddle at 3,150 points. That brought me a good premium income. Also I sold the spread at 3,000/ 2,850 points.

But never I thought that the index could crash further down another 300 points on Monday. Selling the straddle and using spreads as protection did not offer many buffer for the volatility spike that we saw on that Monday during the trading hours.

That led to the next problem that my margin has been crushed and I needed to do further adjustments that costed hell of a money to do. After many trades and adjustments I finally decided -- too late -- to use short futures to hedge the downside risk.

I closed all spreads as far as possible to take advantage of the higher spread value and to buy long puts for absolute protection. Additionally, I closed all open short calls for September to take advantage of the minimal intrinsic value that was left in those positions. And that also gave me more margin. I also closed the 3,550 short put to reduce the downside risk a bit.

Let's have a look at the result with all open positions right now (click to zoom):

Mistake Analysis

What mistakes have I done that led to this horror drop of depot value? Is it a general mistake in my strategy that I did not saw until now? So far, I would say the strategy still works fine. The idea of rolling down the straddles as the index moves lower is not a bad one at all.

What killed my performance was the fact that I did not cover all short put positions with a respective long put insurance. I never thought that a crash like that would be possible at this time.

If we look at last weeks open positions we can see that I had 8 open short positions in EuroStoxx 50. At the same time, we can see that I only had 6 long put options. So there were 2 naked puts hanging.

What did I do on Monday? I opened another straddle using a bear put spread as protection. In fact, I added another short put to the calculation leaving me with 3 naked puts in the crash scenario.

In hindsight, the wise move to do on Monday would have been to cover the naked puts with futures after the drop below 3,100 points. That would have saved me many premium for expensive put options. I could have bought them after the market bounced back to 3,200 points two days later.

Even better would have been the move to close the trade early with a win of more than 1,000 EUR or 10 % in less than 2 months. Not doing that, is that what we call greed?

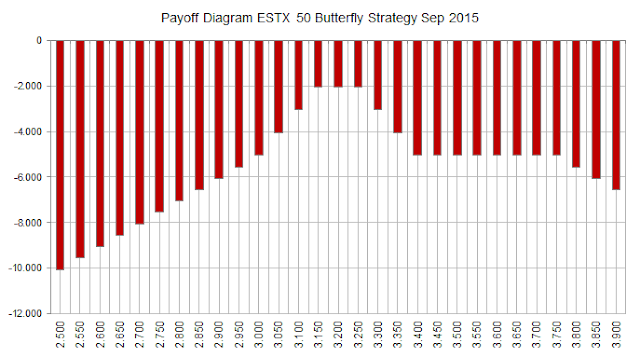

Lets have a short look at the payoff diagram:

To be honest, there is nothing else to say then that looks awful! Principally I locked in a huge loss of almost 6,000 Euro in worst case. In best case the loss can go down to only 4,180 points if the ESTX50 closes as 3,150 points. Compared to the possible win of 3,000 Euro the loss is still fine. But knowing that the account is only 10,000 EUR big, the loss is quite game-changing.

Outlook for week 36

For next week I will put another 2,000 EUR in the account to keep myself into the game. I have already opened new positions for December expiration at 3,350 and 3,150 points that are insured at 3,000 points.

The current positions for September will be closed step by step if possible without paying high premiums. If that is not possible, I will simply wait until expiration. In any case there are not many options to increase profits at this time as any adjustment will also increase risk on the other side again that could mean in worst case losing even more money an a losing trade.

Regarding the December opening I will post a separate article with the related information and diagrams.

For now, I will take care of my wounds. I will lean back a bit and will try to calm my emotions to be ready for the next series.

Note to myself:

Always use long put insurance.

Close trades early with 50 percent of profit.

Don't let winners become losers.

Should I close positions before the expiration of the second month, meaning after half of the 3 months period?