Last week has been kind of boring after the huge market moves at the end of August. Everybody seems to be waiting for the FED? EuroStoxx 50 closed around 3,200 points and volatility in VSTOXX was around 30 points.

There was a good thing and a bad thing: The good thing first -- the EuroStoxx 50 trades exactly in my range of maximum profit between 3,150 points and 3,250 points. I do not wanna say, there is a real chance of making any profit this month after the desctructive results in August, but at least there is a good chance of reducing the loss.

The bad thing is -- the EuroStoxx 50 trades exactly in my range of maximum profit! Why is that bad? My problem is that I generally do not believe that an Index will be flat for a very long period of time. So it might happen that it swings in a narrow or wide range, but I am not sure if it really keeps on staying flat around 3,200 points for long. That means at the same time that the risk increases with every day that the Index will break out in one direction or the other!

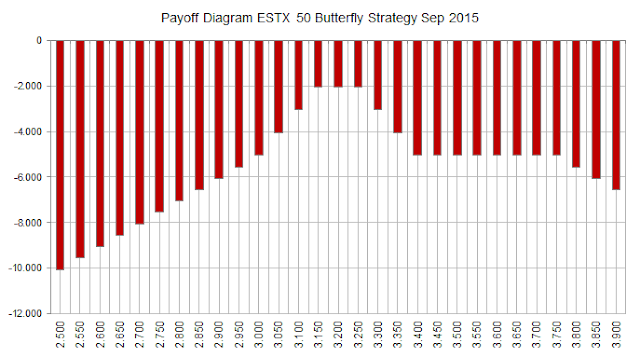

So what do I do? Is it wise to hold on and pray that the index will stay flat till expiration? Let's just have a look of the payoff diagram as it was on Friday after markets closing (click to zoom):

We can clearly see that my losses quickly add up if the index market moves more than a hundred points in any direction!

On Friday I decided to keep on holding. The facts make sense that everyone will wait for Thursday for the FED announcement.

But as we have already Monday now, I have to admit that I finally chose to close out my open positions half an hour before the European markets closed! I do not want to take the risk of further losses anymore and just take what I already have.

In real trading we are talking about closing the straddle at 3,150 points for a profit of 1,233 EUR and closing the straddle at 3,250 points for a profit of 298 EUR. At the same time, I sold the long put insurance at 3,000 points for a little time value of 56 EUR and the long calls at 3,400 for a value of 22 EUR. All summed up, I earned 1,609 EUR for a profit of 1,017 EUR.

The biggest loss is still outstanding: The naked put at 3,750 points and the short future at 3,115 points. That will result in expenses of 6,350 EUR. The premium earned before was only 1,558 EUR leaving the position with a loss of 4,792 EUR.

That is the new payoff diagram with only two open positions left (click to zoom):

In fact the position is frozen now. The loss is a fact, but what is more important to me is the exclusion of risk. I do not have to worry anymore what happens on Thursday. My margin is finally back in a reasonable level and I have room to work with my December positions that also might need some further adjustments.

My total loss on the whole trade since opened in June will be 3,187 EUR.

No comments:

Post a Comment