We ended last week with a strong run up on 3,450 points which is kind of over my preferred range of 3,400 points. From here I am already in the zone of losses. Having 3 short call options open means, with every point up from here I lose 30 EUR. That is kind of the situation I would like to avoid.

Because of that I have opened the next short put option at 3,550 points on Friday to give me a little room to breath. But after crunching the numbers on the weekend I figured out, that this step does not really do the trick yet. One put option still means there is 2 naked call options costing me money on the upside. In fact, my protection begins at 3,700 points where I have bought my long call options. Running up another 250 points would mean a loss of 2,500 EUR alread for those 2 options plus another 2,000 EUR for the third call starting after 3,550 points.

To understand the positioning to the fullest, you can have a look at my position table down below. So far, I am delta negative, which means, on markets moving higher I lose money. Markets going down will make me some money.

As we are already in Tuesday night as I am typing those lines, I have to admit, that the strategy was not optimal for this period once again. The market made a strong move from less than 3,000 points up to 3,450 points leaving me with a wide range and no clear restistance at the current level.

So far, I will close out the low call at 2,950 points and take profit an the lowest naked put option at 3,150 points. That means, my range moves a bit higher. At the same time, due to my payments to close the call option, I am running out of premium to get my complete position in a win.

What are my possibilies now? At first, I could sell another straddle at 3,450 points to narrow the net and earn round about 200 points here. That would offer me a nice buffer. My new range would be between 3,300 points and 3,500 points. If we moved down again, I could sell another straddle at 3,250 points. So my range would widen again a bit from 3,200 to 3,500 points.

What I do not like with that idea is the essential risk on the upside. I really have to think through if I try to work that out or if I cut losses and focus on the next month.

As I will be on holiday in the Philippines with my wife in November, I feel that closing out and having a good off time would be the better choice. I will have to decide until Friday...

2015/10/28

2015/10/20

Short Butterfly Dec 2015 - Performance Report Week 42/2015

Last week, EuroStoxx 50 closed above 3,260 points. Volatility keeps on going down. Currently, I am still facing some losses due to high expenses for insurance in September and October. For my next trading period, I will try to keep those expenses low. I figured out that options valuation is more stable with expireation some months out. That means it could make sense to reduce protection in the beginning and buy better insurance a month or two later.

The maximum profit is at the moment around 3,700 EUR. Focussing on my profit target of 50 % of that we still have a long way to go. The position is at risk if the EuroStoxx 50 moves above 3,400 points or below 2,800 points. To me that feels like a pretty comfortable profit zone right now.

The question is, what do I do if me move further up. Chart show bearish resistance between 3,300 and 3,400 points. If we move closer to 3,350 points I would feel extend my position at 3,250 and 3,450 points. At the same the short call option at 2,950 have to be closed if possible. Or will will buy one FESX future to cover the position.

The maximum profit is at the moment around 3,700 EUR. Focussing on my profit target of 50 % of that we still have a long way to go. The position is at risk if the EuroStoxx 50 moves above 3,400 points or below 2,800 points. To me that feels like a pretty comfortable profit zone right now.

The question is, what do I do if me move further up. Chart show bearish resistance between 3,300 and 3,400 points. If we move closer to 3,350 points I would feel extend my position at 3,250 and 3,450 points. At the same the short call option at 2,950 have to be closed if possible. Or will will buy one FESX future to cover the position.

2015/10/14

Short Butterfly Dec 2015 - Performance Report Week 41/2015

Just in short the results from last weeks trading: The European market went sideways and tended slightly upwards. All short options are completely in the range. I closed my protective put option spread during the week, so that I am naked on the downside now. I feel fine taking that risk as I am still short 2 call options at 3,150 and 2,950 points that should provide me some buffer. But still, I am shooting for another spread until December for less than 20 points below the strike of 3,000 points. At the moment, the spread at 2,750/ 2,950 comes into my mind trading at 24 points.

The maximum profit can be reach if we close in December at 3,150 points. As I am planning to close early in November, I am still monitoring the market every day. The volatility came down a lot since the the last drop at the end of August.

Next steps need to be take at 3,450 points (selling short call) and below 2,950 points (selling short put). The October long call protection at 3,400 is going to expire worthless. I think I will add another one after I got my bottom line safe with new put option protection.

At the moment is earnings seaons and you never know what the next day will bring!

The maximum profit can be reach if we close in December at 3,150 points. As I am planning to close early in November, I am still monitoring the market every day. The volatility came down a lot since the the last drop at the end of August.

Next steps need to be take at 3,450 points (selling short call) and below 2,950 points (selling short put). The October long call protection at 3,400 is going to expire worthless. I think I will add another one after I got my bottom line safe with new put option protection.

At the moment is earnings seaons and you never know what the next day will bring!

2015/10/08

Short Butterfly Dec 2015: Position Update

This week I have closed the short put options at 2,750 points that will expire end of October. Now, there is only 2 October long put options at 2,950 that are almost worthless for my December strategy. The premium is already very low and I wanted to reduce risk on the downside a bit.

At the moment it looks like we will keep on moving higher -- but as usual -- things can change from one day to another.

That is why I will keep the ball low and make sure to reduce risks as fast as possible.

Currently my break even points are around 2,900 and 3,400 points in EuroStoxx 50. So looking at a price of 3,200 at the moment, we are pretty comfortably situated in the range!

At the moment it looks like we will keep on moving higher -- but as usual -- things can change from one day to another.

That is why I will keep the ball low and make sure to reduce risks as fast as possible.

Currently my break even points are around 2,900 and 3,400 points in EuroStoxx 50. So looking at a price of 3,200 at the moment, we are pretty comfortably situated in the range!

2015/10/05

Short Butterfly Dec 2015 - Performance Report Week 40/2015

The EuroStoxx 50 closed last week at 3,137 and the VSTOXX closed at 31 points. Compared to the week before we are up more than 100 points. Related to the range for my options we are doing great at the moment. Break even points in December are between 2,900 and 3,400 points with maximum profit at 3,150 points at the strike of the middle short option straddle.

The put spread at 2,750/ 2,950 will expire in two weeks. So does the long call option at 3,400 points. At the moment, volatility is high and a direction is far from obvious. I am still afraid of further drops down. That keeps me holding my put spreads that extend the range at least for 2 weeks down to 2,750 points before I will have pressure for adjustments. The long call is meant to reduce margin requirements, because I hold 1 short call at 2,950 more than short puts (the 2,950 short put option is still missing).

The current positions hold are described as follows (click to zoom):

At the levels of 3,150 points and 3,350 points the straddles are still open and doing just fine. At the time when I have to sell my next short put at 2,950 points, I will close the highest strike straddle -- or put a short future against it to cut losses.

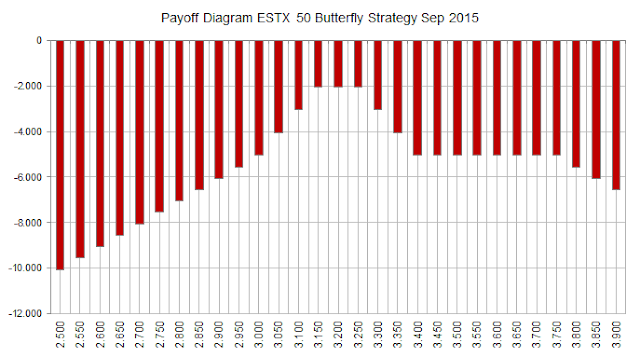

The payoff diagram can show quite clear what is the range of profit at the moment (click to zoom):

Based on that, I feel with my current holdings quite comfortable. As long as we do not see chances of more than 10 percent in any direction that short butterfly should ba nice holding to earn time premium.

Next steps have to be taken in following situations:

ESTX50 falling below 2,950 points: Sell missing short put option, sell future to over 3,350 put option.

ESTX50 rising above 3,400 points: Sell short call option at 3,550 points.

Expiration of October Put-Spread: Buy of November or December positions based on volatility.

Based on both scenarios we can move 6 percent down or 8 percent up. We are in the middle of my current range and I will do my best to keep that sitation going.

The put spread at 2,750/ 2,950 will expire in two weeks. So does the long call option at 3,400 points. At the moment, volatility is high and a direction is far from obvious. I am still afraid of further drops down. That keeps me holding my put spreads that extend the range at least for 2 weeks down to 2,750 points before I will have pressure for adjustments. The long call is meant to reduce margin requirements, because I hold 1 short call at 2,950 more than short puts (the 2,950 short put option is still missing).

The current positions hold are described as follows (click to zoom):

At the levels of 3,150 points and 3,350 points the straddles are still open and doing just fine. At the time when I have to sell my next short put at 2,950 points, I will close the highest strike straddle -- or put a short future against it to cut losses.

The payoff diagram can show quite clear what is the range of profit at the moment (click to zoom):

Based on that, I feel with my current holdings quite comfortable. As long as we do not see chances of more than 10 percent in any direction that short butterfly should ba nice holding to earn time premium.

Next steps have to be taken in following situations:

ESTX50 falling below 2,950 points: Sell missing short put option, sell future to over 3,350 put option.

ESTX50 rising above 3,400 points: Sell short call option at 3,550 points.

Expiration of October Put-Spread: Buy of November or December positions based on volatility.

Based on both scenarios we can move 6 percent down or 8 percent up. We are in the middle of my current range and I will do my best to keep that sitation going.

2015/09/27

Short Butterfly Dec 2015 - Performance Report Week 39/2015

Due to personal circumstances I have not been able to publish a report last weekend. Hower, the changes were only minimal. EuroStoxx 50 closed on Friday at 3,113 points and VStoxx closed at 30.5 points.

At the end, the two long put options at 3,000 points expired worthless leaving me with a loss of 458 EUR.

In the same week before expiration I bought already protection for October: 2 long puts at 2,950 points and 2 short put options at 2,750 points for a total debit of 576 EUR.

On the upside I have extended my long call option at 3700 with another contract for 123 EUR to reduce margin and leave room to move in case we do really move upwards again. But at the moment, I do not see that coming.

On September 22, the markets made another big move down below 3,100 points. During the trading hours we saw prices around 3,050 points so that I decided to build up the next leg of the straddle at 2,950 points. After my my last experience in August I prefer to have a bit more buffer on the downside.

I sold one contract short call option 2,950 points for December earning a premium of 2,345 EUR. So the total premium received goes up to 9,331 EUR. To cover the short call, I bought a long call option for october at 3,400 points for 35 dollars to reduce margin requirements by more than a thousand EUR.

The new payoff diagramm including insurance by October expiration looks as follows (click to zoom in):

The short put option will be sold after we close below 2,950 points. If that happens, I will have to close the straddle at 3,350 points to reduce possible losses.

My current positions:

At the moment, the whole short option straddles trade at a profit of 320 EUR. But the negative influence of the insurance leaves me with a loss of 753 EUR in the books. All in all we see a loss of -433 EUR.

But there are still 2 months to go.

At the end, the two long put options at 3,000 points expired worthless leaving me with a loss of 458 EUR.

In the same week before expiration I bought already protection for October: 2 long puts at 2,950 points and 2 short put options at 2,750 points for a total debit of 576 EUR.

On the upside I have extended my long call option at 3700 with another contract for 123 EUR to reduce margin and leave room to move in case we do really move upwards again. But at the moment, I do not see that coming.

On September 22, the markets made another big move down below 3,100 points. During the trading hours we saw prices around 3,050 points so that I decided to build up the next leg of the straddle at 2,950 points. After my my last experience in August I prefer to have a bit more buffer on the downside.

I sold one contract short call option 2,950 points for December earning a premium of 2,345 EUR. So the total premium received goes up to 9,331 EUR. To cover the short call, I bought a long call option for october at 3,400 points for 35 dollars to reduce margin requirements by more than a thousand EUR.

The new payoff diagramm including insurance by October expiration looks as follows (click to zoom in):

The short put option will be sold after we close below 2,950 points. If that happens, I will have to close the straddle at 3,350 points to reduce possible losses.

My current positions:

At the moment, the whole short option straddles trade at a profit of 320 EUR. But the negative influence of the insurance leaves me with a loss of 753 EUR in the books. All in all we see a loss of -433 EUR.

But there are still 2 months to go.

2015/09/15

Performance Report Week 37/2015

Last week has been kind of boring after the huge market moves at the end of August. Everybody seems to be waiting for the FED? EuroStoxx 50 closed around 3,200 points and volatility in VSTOXX was around 30 points.

There was a good thing and a bad thing: The good thing first -- the EuroStoxx 50 trades exactly in my range of maximum profit between 3,150 points and 3,250 points. I do not wanna say, there is a real chance of making any profit this month after the desctructive results in August, but at least there is a good chance of reducing the loss.

The bad thing is -- the EuroStoxx 50 trades exactly in my range of maximum profit! Why is that bad? My problem is that I generally do not believe that an Index will be flat for a very long period of time. So it might happen that it swings in a narrow or wide range, but I am not sure if it really keeps on staying flat around 3,200 points for long. That means at the same time that the risk increases with every day that the Index will break out in one direction or the other!

So what do I do? Is it wise to hold on and pray that the index will stay flat till expiration? Let's just have a look of the payoff diagram as it was on Friday after markets closing (click to zoom):

We can clearly see that my losses quickly add up if the index market moves more than a hundred points in any direction!

On Friday I decided to keep on holding. The facts make sense that everyone will wait for Thursday for the FED announcement.

But as we have already Monday now, I have to admit that I finally chose to close out my open positions half an hour before the European markets closed! I do not want to take the risk of further losses anymore and just take what I already have.

In real trading we are talking about closing the straddle at 3,150 points for a profit of 1,233 EUR and closing the straddle at 3,250 points for a profit of 298 EUR. At the same time, I sold the long put insurance at 3,000 points for a little time value of 56 EUR and the long calls at 3,400 for a value of 22 EUR. All summed up, I earned 1,609 EUR for a profit of 1,017 EUR.

The biggest loss is still outstanding: The naked put at 3,750 points and the short future at 3,115 points. That will result in expenses of 6,350 EUR. The premium earned before was only 1,558 EUR leaving the position with a loss of 4,792 EUR.

That is the new payoff diagram with only two open positions left (click to zoom):

In fact the position is frozen now. The loss is a fact, but what is more important to me is the exclusion of risk. I do not have to worry anymore what happens on Thursday. My margin is finally back in a reasonable level and I have room to work with my December positions that also might need some further adjustments.

My total loss on the whole trade since opened in June will be 3,187 EUR.

There was a good thing and a bad thing: The good thing first -- the EuroStoxx 50 trades exactly in my range of maximum profit between 3,150 points and 3,250 points. I do not wanna say, there is a real chance of making any profit this month after the desctructive results in August, but at least there is a good chance of reducing the loss.

The bad thing is -- the EuroStoxx 50 trades exactly in my range of maximum profit! Why is that bad? My problem is that I generally do not believe that an Index will be flat for a very long period of time. So it might happen that it swings in a narrow or wide range, but I am not sure if it really keeps on staying flat around 3,200 points for long. That means at the same time that the risk increases with every day that the Index will break out in one direction or the other!

So what do I do? Is it wise to hold on and pray that the index will stay flat till expiration? Let's just have a look of the payoff diagram as it was on Friday after markets closing (click to zoom):

We can clearly see that my losses quickly add up if the index market moves more than a hundred points in any direction!

On Friday I decided to keep on holding. The facts make sense that everyone will wait for Thursday for the FED announcement.

But as we have already Monday now, I have to admit that I finally chose to close out my open positions half an hour before the European markets closed! I do not want to take the risk of further losses anymore and just take what I already have.

In real trading we are talking about closing the straddle at 3,150 points for a profit of 1,233 EUR and closing the straddle at 3,250 points for a profit of 298 EUR. At the same time, I sold the long put insurance at 3,000 points for a little time value of 56 EUR and the long calls at 3,400 for a value of 22 EUR. All summed up, I earned 1,609 EUR for a profit of 1,017 EUR.

The biggest loss is still outstanding: The naked put at 3,750 points and the short future at 3,115 points. That will result in expenses of 6,350 EUR. The premium earned before was only 1,558 EUR leaving the position with a loss of 4,792 EUR.

That is the new payoff diagram with only two open positions left (click to zoom):

In fact the position is frozen now. The loss is a fact, but what is more important to me is the exclusion of risk. I do not have to worry anymore what happens on Thursday. My margin is finally back in a reasonable level and I have room to work with my December positions that also might need some further adjustments.

My total loss on the whole trade since opened in June will be 3,187 EUR.

Subscribe to:

Posts (Atom)