This week I have closed the short put options at 2,750 points that will expire end of October. Now, there is only 2 October long put options at 2,950 that are almost worthless for my December strategy. The premium is already very low and I wanted to reduce risk on the downside a bit.

At the moment it looks like we will keep on moving higher -- but as usual -- things can change from one day to another.

That is why I will keep the ball low and make sure to reduce risks as fast as possible.

Currently my break even points are around 2,900 and 3,400 points in EuroStoxx 50. So looking at a price of 3,200 at the moment, we are pretty comfortably situated in the range!

2015/10/08

2015/10/05

Short Butterfly Dec 2015 - Performance Report Week 40/2015

The EuroStoxx 50 closed last week at 3,137 and the VSTOXX closed at 31 points. Compared to the week before we are up more than 100 points. Related to the range for my options we are doing great at the moment. Break even points in December are between 2,900 and 3,400 points with maximum profit at 3,150 points at the strike of the middle short option straddle.

The put spread at 2,750/ 2,950 will expire in two weeks. So does the long call option at 3,400 points. At the moment, volatility is high and a direction is far from obvious. I am still afraid of further drops down. That keeps me holding my put spreads that extend the range at least for 2 weeks down to 2,750 points before I will have pressure for adjustments. The long call is meant to reduce margin requirements, because I hold 1 short call at 2,950 more than short puts (the 2,950 short put option is still missing).

The current positions hold are described as follows (click to zoom):

At the levels of 3,150 points and 3,350 points the straddles are still open and doing just fine. At the time when I have to sell my next short put at 2,950 points, I will close the highest strike straddle -- or put a short future against it to cut losses.

The payoff diagram can show quite clear what is the range of profit at the moment (click to zoom):

Based on that, I feel with my current holdings quite comfortable. As long as we do not see chances of more than 10 percent in any direction that short butterfly should ba nice holding to earn time premium.

Next steps have to be taken in following situations:

ESTX50 falling below 2,950 points: Sell missing short put option, sell future to over 3,350 put option.

ESTX50 rising above 3,400 points: Sell short call option at 3,550 points.

Expiration of October Put-Spread: Buy of November or December positions based on volatility.

Based on both scenarios we can move 6 percent down or 8 percent up. We are in the middle of my current range and I will do my best to keep that sitation going.

The put spread at 2,750/ 2,950 will expire in two weeks. So does the long call option at 3,400 points. At the moment, volatility is high and a direction is far from obvious. I am still afraid of further drops down. That keeps me holding my put spreads that extend the range at least for 2 weeks down to 2,750 points before I will have pressure for adjustments. The long call is meant to reduce margin requirements, because I hold 1 short call at 2,950 more than short puts (the 2,950 short put option is still missing).

The current positions hold are described as follows (click to zoom):

At the levels of 3,150 points and 3,350 points the straddles are still open and doing just fine. At the time when I have to sell my next short put at 2,950 points, I will close the highest strike straddle -- or put a short future against it to cut losses.

The payoff diagram can show quite clear what is the range of profit at the moment (click to zoom):

Based on that, I feel with my current holdings quite comfortable. As long as we do not see chances of more than 10 percent in any direction that short butterfly should ba nice holding to earn time premium.

Next steps have to be taken in following situations:

ESTX50 falling below 2,950 points: Sell missing short put option, sell future to over 3,350 put option.

ESTX50 rising above 3,400 points: Sell short call option at 3,550 points.

Expiration of October Put-Spread: Buy of November or December positions based on volatility.

Based on both scenarios we can move 6 percent down or 8 percent up. We are in the middle of my current range and I will do my best to keep that sitation going.

2015/09/27

Short Butterfly Dec 2015 - Performance Report Week 39/2015

Due to personal circumstances I have not been able to publish a report last weekend. Hower, the changes were only minimal. EuroStoxx 50 closed on Friday at 3,113 points and VStoxx closed at 30.5 points.

At the end, the two long put options at 3,000 points expired worthless leaving me with a loss of 458 EUR.

In the same week before expiration I bought already protection for October: 2 long puts at 2,950 points and 2 short put options at 2,750 points for a total debit of 576 EUR.

On the upside I have extended my long call option at 3700 with another contract for 123 EUR to reduce margin and leave room to move in case we do really move upwards again. But at the moment, I do not see that coming.

On September 22, the markets made another big move down below 3,100 points. During the trading hours we saw prices around 3,050 points so that I decided to build up the next leg of the straddle at 2,950 points. After my my last experience in August I prefer to have a bit more buffer on the downside.

I sold one contract short call option 2,950 points for December earning a premium of 2,345 EUR. So the total premium received goes up to 9,331 EUR. To cover the short call, I bought a long call option for october at 3,400 points for 35 dollars to reduce margin requirements by more than a thousand EUR.

The new payoff diagramm including insurance by October expiration looks as follows (click to zoom in):

The short put option will be sold after we close below 2,950 points. If that happens, I will have to close the straddle at 3,350 points to reduce possible losses.

My current positions:

At the moment, the whole short option straddles trade at a profit of 320 EUR. But the negative influence of the insurance leaves me with a loss of 753 EUR in the books. All in all we see a loss of -433 EUR.

But there are still 2 months to go.

At the end, the two long put options at 3,000 points expired worthless leaving me with a loss of 458 EUR.

In the same week before expiration I bought already protection for October: 2 long puts at 2,950 points and 2 short put options at 2,750 points for a total debit of 576 EUR.

On the upside I have extended my long call option at 3700 with another contract for 123 EUR to reduce margin and leave room to move in case we do really move upwards again. But at the moment, I do not see that coming.

On September 22, the markets made another big move down below 3,100 points. During the trading hours we saw prices around 3,050 points so that I decided to build up the next leg of the straddle at 2,950 points. After my my last experience in August I prefer to have a bit more buffer on the downside.

I sold one contract short call option 2,950 points for December earning a premium of 2,345 EUR. So the total premium received goes up to 9,331 EUR. To cover the short call, I bought a long call option for october at 3,400 points for 35 dollars to reduce margin requirements by more than a thousand EUR.

The new payoff diagramm including insurance by October expiration looks as follows (click to zoom in):

The short put option will be sold after we close below 2,950 points. If that happens, I will have to close the straddle at 3,350 points to reduce possible losses.

My current positions:

At the moment, the whole short option straddles trade at a profit of 320 EUR. But the negative influence of the insurance leaves me with a loss of 753 EUR in the books. All in all we see a loss of -433 EUR.

But there are still 2 months to go.

2015/09/15

Performance Report Week 37/2015

Last week has been kind of boring after the huge market moves at the end of August. Everybody seems to be waiting for the FED? EuroStoxx 50 closed around 3,200 points and volatility in VSTOXX was around 30 points.

There was a good thing and a bad thing: The good thing first -- the EuroStoxx 50 trades exactly in my range of maximum profit between 3,150 points and 3,250 points. I do not wanna say, there is a real chance of making any profit this month after the desctructive results in August, but at least there is a good chance of reducing the loss.

The bad thing is -- the EuroStoxx 50 trades exactly in my range of maximum profit! Why is that bad? My problem is that I generally do not believe that an Index will be flat for a very long period of time. So it might happen that it swings in a narrow or wide range, but I am not sure if it really keeps on staying flat around 3,200 points for long. That means at the same time that the risk increases with every day that the Index will break out in one direction or the other!

So what do I do? Is it wise to hold on and pray that the index will stay flat till expiration? Let's just have a look of the payoff diagram as it was on Friday after markets closing (click to zoom):

We can clearly see that my losses quickly add up if the index market moves more than a hundred points in any direction!

On Friday I decided to keep on holding. The facts make sense that everyone will wait for Thursday for the FED announcement.

But as we have already Monday now, I have to admit that I finally chose to close out my open positions half an hour before the European markets closed! I do not want to take the risk of further losses anymore and just take what I already have.

In real trading we are talking about closing the straddle at 3,150 points for a profit of 1,233 EUR and closing the straddle at 3,250 points for a profit of 298 EUR. At the same time, I sold the long put insurance at 3,000 points for a little time value of 56 EUR and the long calls at 3,400 for a value of 22 EUR. All summed up, I earned 1,609 EUR for a profit of 1,017 EUR.

The biggest loss is still outstanding: The naked put at 3,750 points and the short future at 3,115 points. That will result in expenses of 6,350 EUR. The premium earned before was only 1,558 EUR leaving the position with a loss of 4,792 EUR.

That is the new payoff diagram with only two open positions left (click to zoom):

In fact the position is frozen now. The loss is a fact, but what is more important to me is the exclusion of risk. I do not have to worry anymore what happens on Thursday. My margin is finally back in a reasonable level and I have room to work with my December positions that also might need some further adjustments.

My total loss on the whole trade since opened in June will be 3,187 EUR.

There was a good thing and a bad thing: The good thing first -- the EuroStoxx 50 trades exactly in my range of maximum profit between 3,150 points and 3,250 points. I do not wanna say, there is a real chance of making any profit this month after the desctructive results in August, but at least there is a good chance of reducing the loss.

The bad thing is -- the EuroStoxx 50 trades exactly in my range of maximum profit! Why is that bad? My problem is that I generally do not believe that an Index will be flat for a very long period of time. So it might happen that it swings in a narrow or wide range, but I am not sure if it really keeps on staying flat around 3,200 points for long. That means at the same time that the risk increases with every day that the Index will break out in one direction or the other!

So what do I do? Is it wise to hold on and pray that the index will stay flat till expiration? Let's just have a look of the payoff diagram as it was on Friday after markets closing (click to zoom):

We can clearly see that my losses quickly add up if the index market moves more than a hundred points in any direction!

On Friday I decided to keep on holding. The facts make sense that everyone will wait for Thursday for the FED announcement.

But as we have already Monday now, I have to admit that I finally chose to close out my open positions half an hour before the European markets closed! I do not want to take the risk of further losses anymore and just take what I already have.

In real trading we are talking about closing the straddle at 3,150 points for a profit of 1,233 EUR and closing the straddle at 3,250 points for a profit of 298 EUR. At the same time, I sold the long put insurance at 3,000 points for a little time value of 56 EUR and the long calls at 3,400 for a value of 22 EUR. All summed up, I earned 1,609 EUR for a profit of 1,017 EUR.

The biggest loss is still outstanding: The naked put at 3,750 points and the short future at 3,115 points. That will result in expenses of 6,350 EUR. The premium earned before was only 1,558 EUR leaving the position with a loss of 4,792 EUR.

That is the new payoff diagram with only two open positions left (click to zoom):

In fact the position is frozen now. The loss is a fact, but what is more important to me is the exclusion of risk. I do not have to worry anymore what happens on Thursday. My margin is finally back in a reasonable level and I have room to work with my December positions that also might need some further adjustments.

My total loss on the whole trade since opened in June will be 3,187 EUR.

2015/09/06

Start of the Butterfly Strategy for December

At the end of August I have startet the next trade for my strategy with expiration in December 2015. Due to the catastrophe with my September positions I did not find the time to describe the trade yet.

On August 21st just before the crash I started with a straddle at 3,350 points. Just after the weekend, on August 24, the market dropped further and reached the second trigger at 3,150 points. At that strike I sold the next straddle for an even higher premium. At the same time I bought insurance with expiration in September: 2 long put options at 3,000 strike.

As the market moved lower, I added one long call option at 3,700 points for December as protection for a possible rebound to the upside. I liked t he low premium and took the chance to reduce the risk for the whole time to expiration. If the markets go up again, the call can pay for further options to buy in case.

Lets have a look at the open positions (click to zoom in):

After all transactions, the premium received totals 698 points. 64 points have been paid for insurance.

The current break even points are 3,550 on the upside and around 2,950 on the downside. Further adjustments will be made if the market moves below 3,000 or above 3,500. Depending on the possible premium, the new straddle will be sold or just the in the money option.

The resulting payoff diagram looks as following (click to zoom in):

Based on my experience, I will close the position when it is possible to take 50 percent of the maximum profit. At this time, the maximal profit possible will be reached between 3,150 and 3,350 points with 434 points of profit. So the trade will be closed with a profit of 217 points.

Alternatively the position will be tied up 6 weeks before expireation -- that is after half of the trading period -- so that no bigger losses can be made after that point in time. I will have to decide who I will treat that exactly. I prefer to close the whole trade at all.

On August 21st just before the crash I started with a straddle at 3,350 points. Just after the weekend, on August 24, the market dropped further and reached the second trigger at 3,150 points. At that strike I sold the next straddle for an even higher premium. At the same time I bought insurance with expiration in September: 2 long put options at 3,000 strike.

As the market moved lower, I added one long call option at 3,700 points for December as protection for a possible rebound to the upside. I liked t he low premium and took the chance to reduce the risk for the whole time to expiration. If the markets go up again, the call can pay for further options to buy in case.

Lets have a look at the open positions (click to zoom in):

After all transactions, the premium received totals 698 points. 64 points have been paid for insurance.

The current break even points are 3,550 on the upside and around 2,950 on the downside. Further adjustments will be made if the market moves below 3,000 or above 3,500. Depending on the possible premium, the new straddle will be sold or just the in the money option.

The resulting payoff diagram looks as following (click to zoom in):

Based on my experience, I will close the position when it is possible to take 50 percent of the maximum profit. At this time, the maximal profit possible will be reached between 3,150 and 3,350 points with 434 points of profit. So the trade will be closed with a profit of 217 points.

Alternatively the position will be tied up 6 weeks before expireation -- that is after half of the trading period -- so that no bigger losses can be made after that point in time. I will have to decide who I will treat that exactly. I prefer to close the whole trade at all.

Performance Report Week 36/2015

After the horrible week that crushed my depot by almost 50 % the last trading week has been less volatile. The reason is that markets came back a bit and traded in a narrow range between 3,150 points and 3,300 points. Friday closing was at 3,180 points for EuroStoxx 50 and a volatility of 35 points for VStoxx.

I took the chance to further reduce my September positions and closed out the short put option at 3,350 points. At the same time I also closed the corresponding long put option at 3,200 points.

At the end, I am left with a total premium received of 381 points for short options and 50 points of value in long put positions. The short future FESX is negative 85 points. Book value is 741 points to close the short side. The long puts will pay down for 41 points. In real money terms we are talking about a loss of 381 - 741 - 85 - 50 + 41 = 454 points multiplied by 10 equals - 4,540 EUR.

Looking at the payoff diagram, we can see that round about 4,500 EUR is also the maximum loss that I will be facing. That's going to happen if the index moves far away from 3,150 points. That is the strike of the remaining short straddle that carries time value of almost 1,700 EUR.

Ideally I would close the long options now to lock in the their decreasing value and wait until the short options expire. But in that case I will open the position again to the risk of volatility that I want to avoid by all means. So I will hold the long options and lose 50 points to hopefully earn 170 points from the straddle.

The short future will be hold to neutralize the short put at 3,750 points leaving me with a calculated loss of 3,750 - 3,115 = 635 points. Of course, if I just knew that the market would rise further I could close the future early and earn back some points from the short put, but who does really know?

So the strategy for September will be to survive the last 2 weeks and close that dark chapter before I can finally focus completely on my December positions.

I took the chance to further reduce my September positions and closed out the short put option at 3,350 points. At the same time I also closed the corresponding long put option at 3,200 points.

At the end, I am left with a total premium received of 381 points for short options and 50 points of value in long put positions. The short future FESX is negative 85 points. Book value is 741 points to close the short side. The long puts will pay down for 41 points. In real money terms we are talking about a loss of 381 - 741 - 85 - 50 + 41 = 454 points multiplied by 10 equals - 4,540 EUR.

Looking at the payoff diagram, we can see that round about 4,500 EUR is also the maximum loss that I will be facing. That's going to happen if the index moves far away from 3,150 points. That is the strike of the remaining short straddle that carries time value of almost 1,700 EUR.

Ideally I would close the long options now to lock in the their decreasing value and wait until the short options expire. But in that case I will open the position again to the risk of volatility that I want to avoid by all means. So I will hold the long options and lose 50 points to hopefully earn 170 points from the straddle.

The short future will be hold to neutralize the short put at 3,750 points leaving me with a calculated loss of 3,750 - 3,115 = 635 points. Of course, if I just knew that the market would rise further I could close the future early and earn back some points from the short put, but who does really know?

So the strategy for September will be to survive the last 2 weeks and close that dark chapter before I can finally focus completely on my December positions.

2015/08/31

How I lost 50 % of my money in just one week (Report 35/2015)

Last week has been called by many scary names all referring to crash szenarios. The EuroStoxx 50 has gone down to 2,960 points just to go up again to 3,280 points on Friday closing. The Volatility went up to over 30 points, too.

In fact, for my options strategy the week has been worse then ever. All in all I have lost roughly 50 % of my money in just this week. Honestly, that is not acceptable at all and a real catastrophe.

Looking back on my Performance Report in week 34 I have to say, that I fulfilled the plan and opened the straddle at 3,150 points. That brought me a good premium income. Also I sold the spread at 3,000/ 2,850 points.

But never I thought that the index could crash further down another 300 points on Monday. Selling the straddle and using spreads as protection did not offer many buffer for the volatility spike that we saw on that Monday during the trading hours.

That led to the next problem that my margin has been crushed and I needed to do further adjustments that costed hell of a money to do. After many trades and adjustments I finally decided -- too late -- to use short futures to hedge the downside risk.

I closed all spreads as far as possible to take advantage of the higher spread value and to buy long puts for absolute protection. Additionally, I closed all open short calls for September to take advantage of the minimal intrinsic value that was left in those positions. And that also gave me more margin. I also closed the 3,550 short put to reduce the downside risk a bit.

Let's have a look at the result with all open positions right now (click to zoom):

What mistakes have I done that led to this horror drop of depot value? Is it a general mistake in my strategy that I did not saw until now? So far, I would say the strategy still works fine. The idea of rolling down the straddles as the index moves lower is not a bad one at all.

What killed my performance was the fact that I did not cover all short put positions with a respective long put insurance. I never thought that a crash like that would be possible at this time.

If we look at last weeks open positions we can see that I had 8 open short positions in EuroStoxx 50. At the same time, we can see that I only had 6 long put options. So there were 2 naked puts hanging.

What did I do on Monday? I opened another straddle using a bear put spread as protection. In fact, I added another short put to the calculation leaving me with 3 naked puts in the crash scenario.

In hindsight, the wise move to do on Monday would have been to cover the naked puts with futures after the drop below 3,100 points. That would have saved me many premium for expensive put options. I could have bought them after the market bounced back to 3,200 points two days later.

Even better would have been the move to close the trade early with a win of more than 1,000 EUR or 10 % in less than 2 months. Not doing that, is that what we call greed?

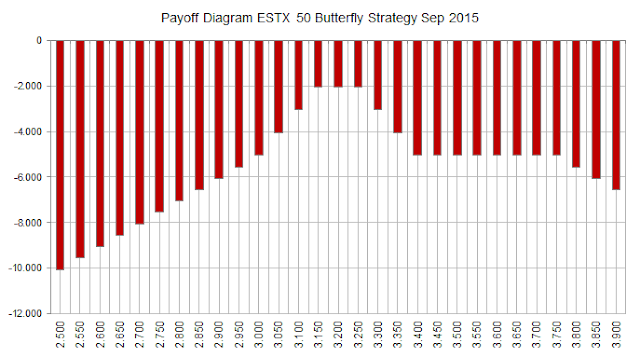

Lets have a short look at the payoff diagram:

To be honest, there is nothing else to say then that looks awful! Principally I locked in a huge loss of almost 6,000 Euro in worst case. In best case the loss can go down to only 4,180 points if the ESTX50 closes as 3,150 points. Compared to the possible win of 3,000 Euro the loss is still fine. But knowing that the account is only 10,000 EUR big, the loss is quite game-changing.

For next week I will put another 2,000 EUR in the account to keep myself into the game. I have already opened new positions for December expiration at 3,350 and 3,150 points that are insured at 3,000 points.

The current positions for September will be closed step by step if possible without paying high premiums. If that is not possible, I will simply wait until expiration. In any case there are not many options to increase profits at this time as any adjustment will also increase risk on the other side again that could mean in worst case losing even more money an a losing trade.

Regarding the December opening I will post a separate article with the related information and diagrams.

For now, I will take care of my wounds. I will lean back a bit and will try to calm my emotions to be ready for the next series.

Note to myself:

Always use long put insurance.

Close trades early with 50 percent of profit.

Don't let winners become losers.

Should I close positions before the expiration of the second month, meaning after half of the 3 months period?

In fact, for my options strategy the week has been worse then ever. All in all I have lost roughly 50 % of my money in just this week. Honestly, that is not acceptable at all and a real catastrophe.

Looking back on my Performance Report in week 34 I have to say, that I fulfilled the plan and opened the straddle at 3,150 points. That brought me a good premium income. Also I sold the spread at 3,000/ 2,850 points.

But never I thought that the index could crash further down another 300 points on Monday. Selling the straddle and using spreads as protection did not offer many buffer for the volatility spike that we saw on that Monday during the trading hours.

That led to the next problem that my margin has been crushed and I needed to do further adjustments that costed hell of a money to do. After many trades and adjustments I finally decided -- too late -- to use short futures to hedge the downside risk.

I closed all spreads as far as possible to take advantage of the higher spread value and to buy long puts for absolute protection. Additionally, I closed all open short calls for September to take advantage of the minimal intrinsic value that was left in those positions. And that also gave me more margin. I also closed the 3,550 short put to reduce the downside risk a bit.

Let's have a look at the result with all open positions right now (click to zoom):

Mistake Analysis

What mistakes have I done that led to this horror drop of depot value? Is it a general mistake in my strategy that I did not saw until now? So far, I would say the strategy still works fine. The idea of rolling down the straddles as the index moves lower is not a bad one at all.

What killed my performance was the fact that I did not cover all short put positions with a respective long put insurance. I never thought that a crash like that would be possible at this time.

If we look at last weeks open positions we can see that I had 8 open short positions in EuroStoxx 50. At the same time, we can see that I only had 6 long put options. So there were 2 naked puts hanging.

What did I do on Monday? I opened another straddle using a bear put spread as protection. In fact, I added another short put to the calculation leaving me with 3 naked puts in the crash scenario.

In hindsight, the wise move to do on Monday would have been to cover the naked puts with futures after the drop below 3,100 points. That would have saved me many premium for expensive put options. I could have bought them after the market bounced back to 3,200 points two days later.

Even better would have been the move to close the trade early with a win of more than 1,000 EUR or 10 % in less than 2 months. Not doing that, is that what we call greed?

Lets have a short look at the payoff diagram:

To be honest, there is nothing else to say then that looks awful! Principally I locked in a huge loss of almost 6,000 Euro in worst case. In best case the loss can go down to only 4,180 points if the ESTX50 closes as 3,150 points. Compared to the possible win of 3,000 Euro the loss is still fine. But knowing that the account is only 10,000 EUR big, the loss is quite game-changing.

Outlook for week 36

For next week I will put another 2,000 EUR in the account to keep myself into the game. I have already opened new positions for December expiration at 3,350 and 3,150 points that are insured at 3,000 points.

The current positions for September will be closed step by step if possible without paying high premiums. If that is not possible, I will simply wait until expiration. In any case there are not many options to increase profits at this time as any adjustment will also increase risk on the other side again that could mean in worst case losing even more money an a losing trade.

Regarding the December opening I will post a separate article with the related information and diagrams.

For now, I will take care of my wounds. I will lean back a bit and will try to calm my emotions to be ready for the next series.

Note to myself:

Always use long put insurance.

Close trades early with 50 percent of profit.

Don't let winners become losers.

Should I close positions before the expiration of the second month, meaning after half of the 3 months period?

Subscribe to:

Posts (Atom)