Adjustment to the Upside

The adjustment points on the upside at 2,050 points were triggered on Wednesday. I added another butterfly to the position centered at 2,040 strike price. The long wings are 70 points wide at 1,970 and 2,110 based on the S&P 500 Future (ES).

The new adjustment points move to 1,960 and 2,090 points.

Since then, S&P 500 continued to rise sharply and triggered the 2,090 level already. Up to now, I did not do any further adjustment.

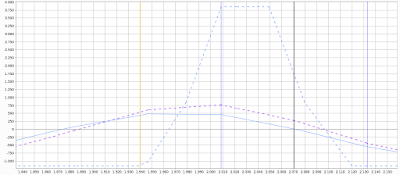

The new position looks as following (click the picture to zoom). Don't get confused with the strikes, because TWS uses the SPX underlying for the diagram, that trades a few points higher than the September-Future.

Worth to note is the T+0 line which is not that flat anymore. If the markets rise, the position will get under pressure faster.

Outlook

Depending were we will be heading on Monday, there are two possible alternatives.

1. I can wait and see, if the the resistance level stops the S&P 500 from a further move upwards.

2. I can add the next Butterfly, that would be centered at 2,070 or 2,080 points. This time, I would narrow the upper wing a bit. So I could reduce negative delta and limit losses.

If the market really breaks through the resistance, I would have to close the position for a loss and wait for a better entry later this month.